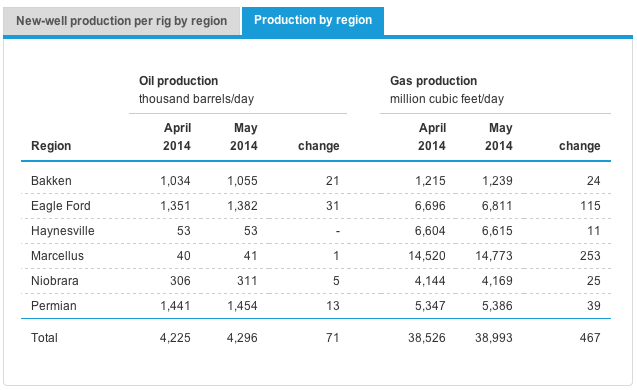

According to a recent drilling report from the United States Energy Information Administration (EIA), oil and gas production in the Bakken, Niobrara, Permian, Eagle Ford, Haynesville, and Marcellus shale fields is set to increase notably during the month of May. What’s more, separate EIA estimates anticipate the United States to greatly reduce its energy imports over the next thirty years.

The EIA predicts a 71,000-barrel daily increase across the major shale basins in the lower 48 United States. The Eagle Ford basin continues to lead production, accounting for 44% of the anticipated surge in May.

Natural gas is produced most prevalently in the Marcellus shale basin, a series of deposits spanning New York, Pennsylvania, and West Virginia. Overall, the EIA anticipates a net increase of 467,000,000 cubic feet per day across the six major basins; over half (54%) of that anticipated increase is attributed the Marcellus shale fields.

Along with these reports of a short-term surge in production, the EIA has issued statements and presented data through the early release overview of the Annual Energy Outlook 2014 pointing toward higher energy independence and significantly reduced imports of gas and liquid energy for the United States.

Confidence in long term oil and gas production in the United States’ shale fields is growing as private corporations corroborate the EIA’s predictions. BHP Billiton, a multinational company considered by 2013 revenues to be the largest mining company in the world, has increased efforts to capitalize on the Eagle Ford basin, citing a plan to double their production in the region by 2016.

Increase in production in the six major shale fields is expected to further exacerbate the problem of crowded shale basin locales – townships already struggling with artificially inflated costs of living, lack of adequate housing, and overpopulation caused by the influx of shale field workers.

As technology, drilling techniques, and well spacing strategies improve, we can only expect to see continuing growth in the shale oil and gas space. Further, according to the Oil & Gas Financial Journal, roughly half of oilfield service and upstream companies are counting on shale oil and gas plays to provide the majority of their 2014 revenues.

Without a doubt, shale and oil plays are set to become a major fixture of onshore drilling strategies for global and domestic producers. And as production grows, the United States stands to become a major player in the global energy economy.

Photo Credits:

Photo via eia.gov

Photo by Paul Lowry