Every revolution has its doubters, and the shale revolution is no different. For each of the shale boom’s enthusiastic supporters, there is an equally enthusiastic naysayer claiming that it will bust tomorrow and come crashing down. To make matters worse, there is little concrete data with which to measure the boom’s trajectory, and objective analyses of the situation are few and far between.

Although we can’t say with absolute certainty how the shale boom will play out, we can dispel some of the myths surrounding its future, namely the ones fearmongering about a bust.

Decline Rate Doesn’t Tell the Whole Story

In a nutshell, shale critics warn that because shale wells have an inherently shorter lifespan than traditional wells, and because they see quick declines in production, that the boom has nowhere to go but down. Adding to that point, they explain how oil producers are tapping the most resource-rich sites in each play first, therefore leaving only progressively less profitable sites to be drilled as time goes on. After all, how can the boom grow if we’re drilling the best wells now and continuing to drill increasingly lower output wells in the future?

The truth may surprise you.

The main metric critics use to make these unfavorable predictions is decline rate (DR). But despite the legitimacy of the data, it’s often interpreted outside the context of two other highly important output metrics.

First, the decline rate of a well isn’t relevant when estimated ultimate recovery (EUR) and initial flow rate (IFR) aren’t taken into consideration. EUR, or the total amount of oil expected to be produced from a single well, is a much better measure of shale sustainability. Although it still doesn’t give us a concrete answer on future productivity, it does provide valuable insight into the boom’s trajectory.

For example, a well could have a shockingly high decline rate yet still have high EUR and IFR, meaning its likely to produce plenty of oil over the course of its lifetime, regardless of how quickly its production declines. For example, a well with an EUR of 2 million barrels and a high decline rate could be compared somewhat equally with a well that has an EUR of 1 million barrels and a lower decline rate. Without considering all factors at play, decline rate just doesn’t give us enough information to draw any meaningful conclusions.

Even if Production Were to Wane, Productivity is Growing by the Day

The shale revolution has only been underway for eight years, and during that time, technology has advanced even further beyond the breakthroughs that made it possible in the first place. The need to continue drilling new wells to sustain production, the same need that critics claim will put an end to the boom, can be met easily by the enormous boost in productivity that has swept through the industry.

Oil companies have streamlined the drilling and new well construction process so that it takes very few men, little resources, and barely any time. Judging from the growing efficiency in shale, it’s doubtful that producers will have any trouble keeping up with the demand for new wells.

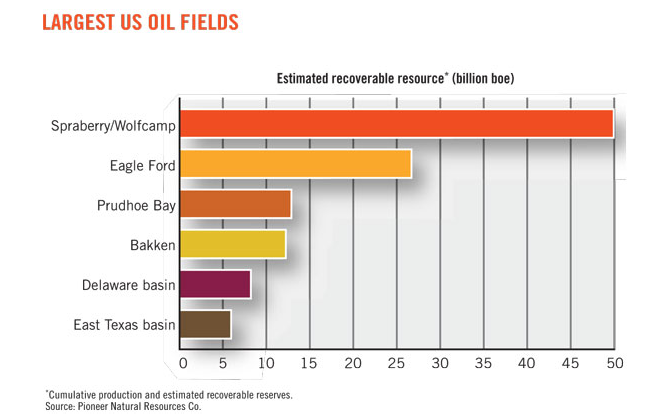

There are Still Many Untapped Plays

Don’t let the critics worry you about dwindling shale play opportunities. Even if some of the best sites are being tapped right now, it’s not as if the rest of the world’s shale is terribly inferior. There are plenty of opportunities to be taken advantage of in the shale industry. In fact, some think that the U.S.’s biggest shale play is still largely untapped – the Texas Spraberry-Wolfcamp formation. And if decreased availability of drilling opportunities were to ever become a problem, it would be one which producers wouldn’t have to face for decades.

Shale is Different

At the end of the day, shale boom critics aren’t totally wrong about the reasons why one might be concerned about a bust. However, their interpretation and context are shaky. Shale is a different animal than conventional oil and gas, and as a result, it can’t be measured and analyzed with the same mindset.

All things considered, the shale energy boom appears poised to keep going for well into the foreseeable future, maybe further.

Photo credits: